Solving the "puzzle" of deductions for real estate upgrades

will give a special provision to the government's tax bill.

The draft budget submitted to Parliament did not provide a clear answer to the question of whether a tax deduction or income deduction will be made for energy and aesthetic upgrading expenses.

Reportedly, however, the government's financial staff has already come up with the type of deduction for real estate, which will be presented in the tax bill in the second half of October.

Building upgrades: Income deduction

A competent source told economists and George Papou how "there is no fiscal space for tax deduction", acknowledging in this way that the benefit to taxpayers would be much greater.

The main question waiting to be answered is whether this deduction from income will be such as to equate taxpayers' "profit" from agreeing changes under the table - that is, cash transactions, excluding 24% VAT, which burdens business. maintenance of a building. As this type of spending is high, the incentive to "disappear" is very strong.

Source: iefimerida.gr - https://www.iefimerida.gr/oikonomia/ekptosi-gia-tin-anabathmisi-akiniton-nomoshedio

What a discount the original plan provided

The original plan envisioned a 40% discount on building upgrades. However, the Preliminary Draft Budget does not mention a specific percentage.

The same source confirms, therefore, that this margin is being considered for the discount to go higher, possibly 50%, so that the incentive to "black" tax-free repairs is weakened.

Property owners, on the other hand, are sounding the alarm at the Treasury for failing the measure, and with concrete examples attempting to reverse decisions. It is no coincidence, moreover, that a government spokesman had just mentioned a tax deduction just 24 hours ago.

Intense reaction from POMIDA

The Pan-Hellenic Federation of Property Owners (POMIDA) strongly reacted to what was included in the preliminary draft budget for the deduction.

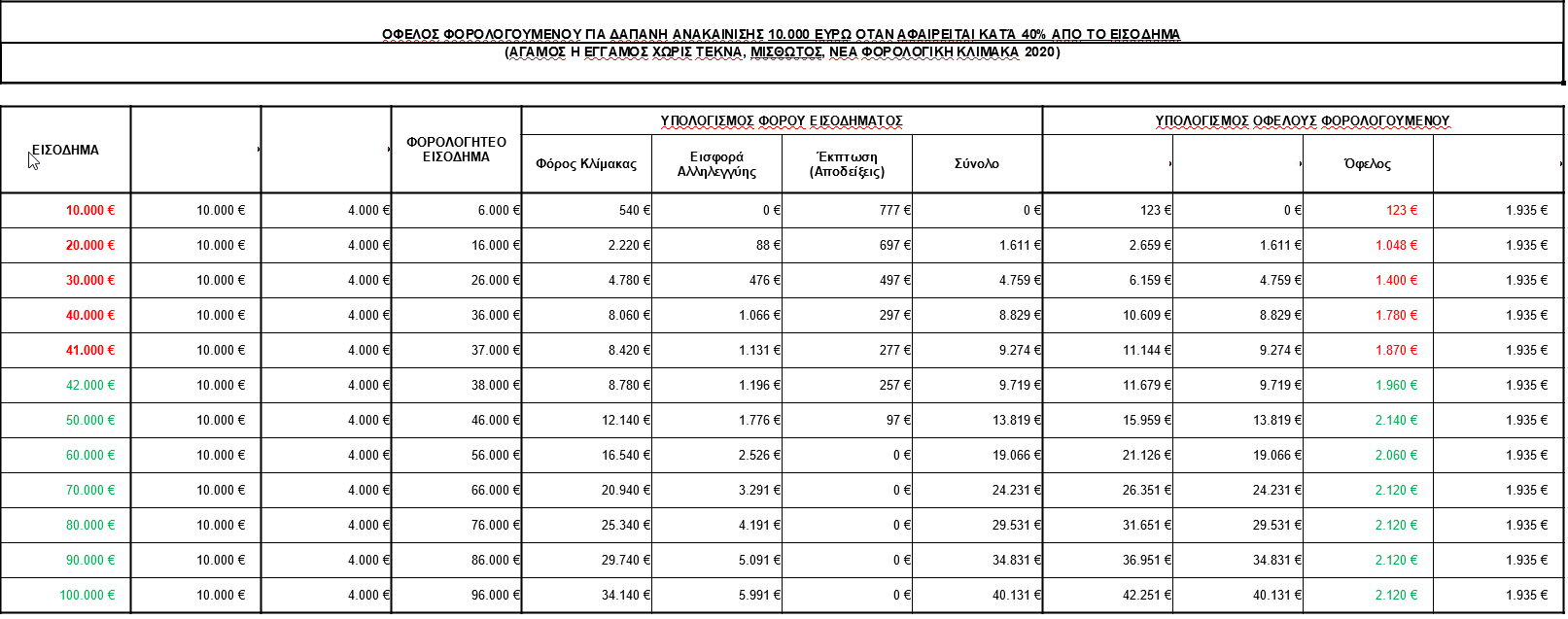

According to POMIDA, the elimination of the 40% tax deduction and the one-off deduction from taxable income "will not only be the impetus for the issuance of legal tax documents, as shown in the accompanying tables but compel the Ministry of Finance to return money to those who would have issued building materials anyway, etc. "

Indicatively, as POMIDA points out, an upgrade fee of EUR 10,000 corresponds to a VAT of EUR 1,935, so if this transaction becomes 'black' then the taxpayer saves that VAT and the professional hides an income of EUR 8,065. What if 40% of the expense is deducted from the income of the taxpayer in question? If his income does not exceed 41,000 euros, then he has a greater benefit in saving VAT, as the maximum tax reduction amounts to 1,870 euros.

Table of examples for employees

The first table with examples relates to the benefit of a deduction for spending 20% of annual income when deducting 40% of income.

Click on the table below to view the details of the table in detail

Solving the "puzzle" of deductions for real estate upgrades will give a special provision to the government's tax bill.

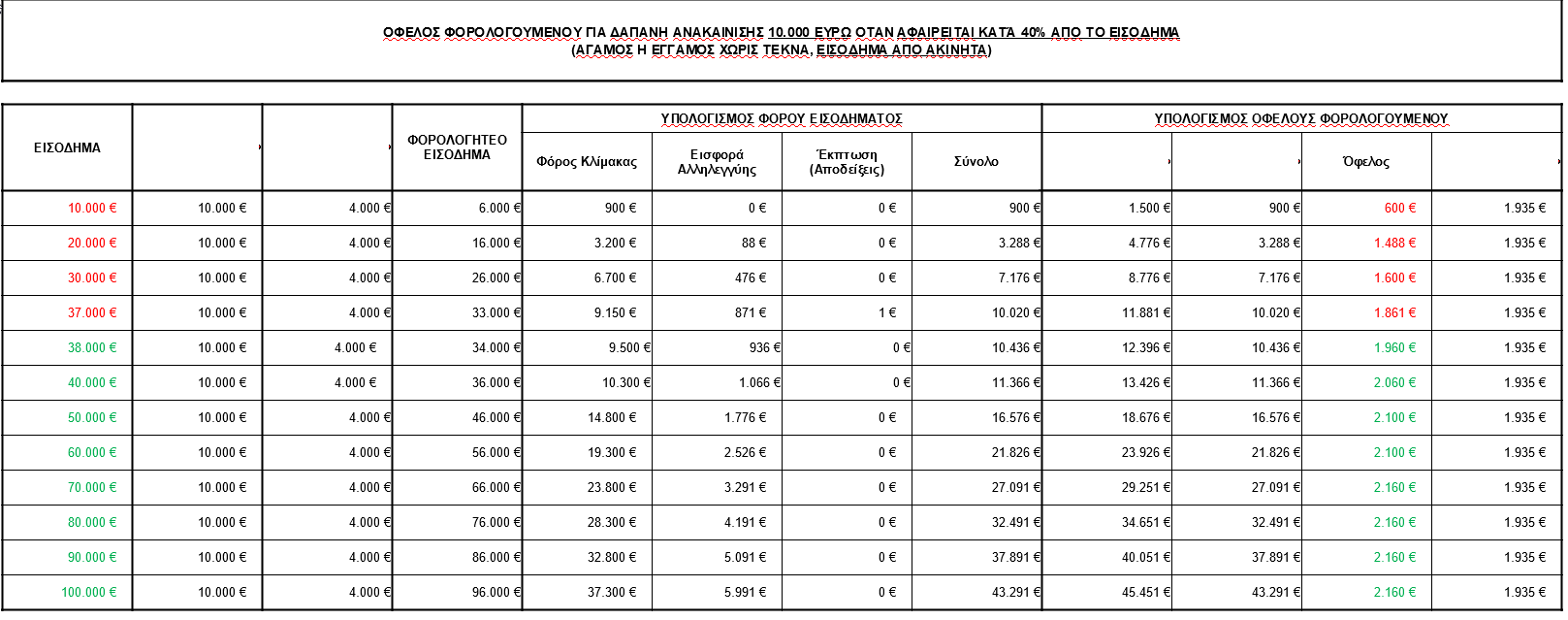

Table for examples with real estate income

Slightly better are things if the taxpayer's income comes from renting real estate. In this case, the benefit of deducting such an expense of 10,000 euros starts from 38,000 euros.

(Click on the table below to view the table details in detail):

The original plan envisioned a 40% discount on building upgrades. However, the Preliminary Draft Budget does not mention a specific percentage.

Mail: info@styletech.gr